Top 10 Tips for Avoiding Financial Scams

In an era where financial transactions are increasingly moving online, the risk of falling prey to scams has escalated. Scammers are continually devising sophisticated schemes to deceive individuals and drain their finances. Protecting your assets and personal information is crucial. This list offers the top 10 tips for avoiding financial scams, providing you with practical strategies to safeguard your finances and personal information against fraudulent schemes.

1. Keep Personal Information Private

Never share sensitive data unless absolutely necessary. Be cautious about sharing personal details like your social security number, banking details, or passwords. Scammers often pose as representatives from legitimate companies to extract this information. Always verify the identity of the person or the legitimacy of the request before divulging any information.

2. Be Wary of Unsolicited Contacts

Scrutinize unexpected calls, emails, or messages. If you receive unsolicited contact, especially those asking for personal or financial information, be cautious. Legitimate organizations will not ask for sensitive information via these methods. Verify the source independently by contacting the organization through official channels.

3. Use Secure Connections

Ensure your internet connection is secure when performing financial transactions. Avoid conducting financial business on public Wi-Fi networks. These networks are often unsecured, making it easier for scammers to intercept your data. Use a secure, private Wi-Fi network or a VPN (Virtual Private Network) for an added layer of security.

4. Regularly Update Software and Systems

Keep your devices and security software up to date. Regular updates are crucial as they often include patches for security vulnerabilities that scammers could exploit. Ensure your computer, smartphone, and other devices are running the latest versions of their operating systems and security software.

5. Recognize Phishing Attempts

Be alert to emails or messages that prompt urgent action. Phishing scams typically involve emails or messages that try to induce panic, prompting you to act quickly. Look out for telltale signs such as generic greetings, spelling mistakes, and suspicious links or attachments.

6. Verify Before You Click

Double-check links and email addresses. Before clicking on any links or downloading attachments, hover over the links to see the actual URL and verify that it is correct. Check the email address to ensure it matches the organization’s official communication.

7. Monitor Financial Statements Regularly

Check your accounts frequently for unauthorized activity. Regularly reviewing your bank and credit card statements can help you catch unauthorized transactions early. If you notice anything suspicious, contact your bank immediately.

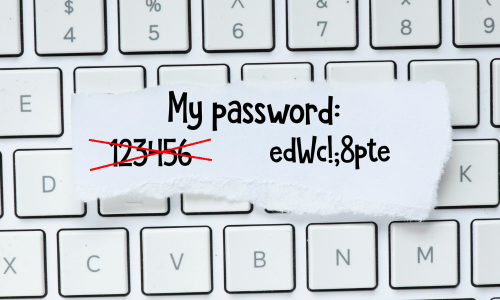

8. Use Strong, Unique Passwords

Create complex passwords and change them regularly. Utilize a combination of letters, numbers, and symbols, and avoid using the same password across multiple sites. Consider using a reputable password manager to keep track of your passwords.

9. Be Skeptical of Too-Good-To-Be-True Offers

If it seems too good to be true, it probably is. High returns with little or no risk, pressure to buy quickly, and promises of guaranteed returns are hallmarks of financial scams. Always research and think critically before investing or sending money.

10. Educate Yourself About Common Scams

Stay informed about the latest scamming tactics. Scammers are continually evolving their methods. Keeping yourself educated about the types of scams that are prevalent can help you recognize and avoid them. Reputable websites like the FTC (Federal Trade Commission) offer resources and alerts about the latest scams.

In the digital age, staying vigilant and informed is your best defence against financial scams. By implementing these top 10 tips, you can significantly reduce your risk of becoming a victim of fraud. Remember, safeguarding your finances is not just about reacting to threats, but proactively establishing habits that ensure your financial security.

We’ve reached the end of our Top 10 countdown, and we’d love to hear from you! Do you agree with our choices, or is there something we missed that you feel deserves a spot on this list? Let’s start a conversation – comment below with your thoughts and ideas. Your input might just influence our next Top 10!